how to file for self employment on taxes

Youll fill this out alongside your Schedule C and also attach it to your 1040 when you file. The self-employed must file a tax return if they earned over 400 per year.

How To Claim Self Employed Expenses Tax Deductions List Small Business Tax Deductions Small Business Tax

Then set up a spreadsheet to include your income and how much of.

. While you may have a 1099 form for some. To report your income you should file a Schedule C with your business income and expenses. These are the required forms when you are self-employed such as Schedule 2. That is a list of the money youve made less the amount youve spent.

Learn how to file self-employment taxes step by step. Working for yourself has. Ad HR Block Offers A Wide Range Of Tax Prep Services To Help You Get Your Maximum Refund. Without a 1099 Form independent contractors.

Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. In order to report your Social Security and Medicare taxes you must file Schedule SE Form 1040 or 1040-SR Self-Employment Tax PDF. Whether You File Your 2022 Tax Returns Online Or In-Office We Can Answer Your Questions. Form SS-4 Employer Identification Number EIN Online Application If youve determined that you need an EIN you.

There is no W-2 self-employed specific form that you can create. You earned less than 400 as a result of self-employment you still have to file an income tax return. The benefit of paying self-employment taxes is that you can take advantage of many self-employment tax deductions to help reduce your tax burden. Ad File 1040ez Free today for a faster refund.

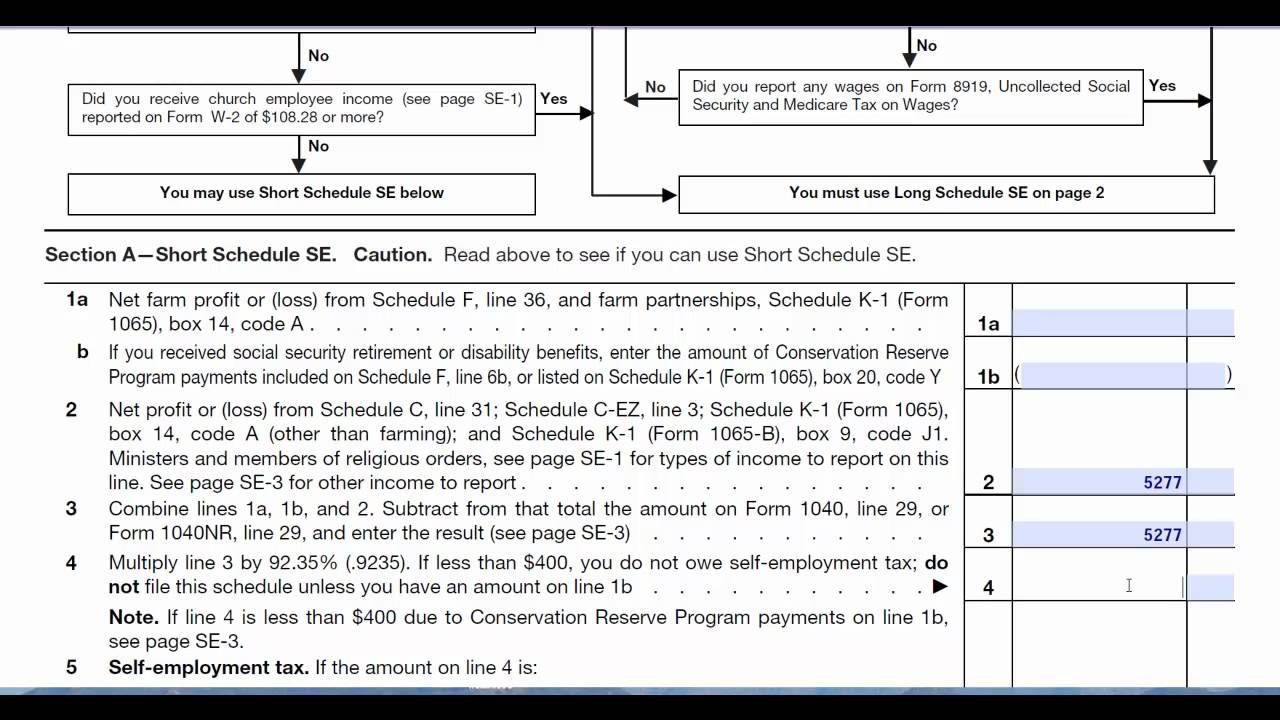

A wealth of information for your employment tax filing needs. Calculate your income and expenses. Ad What Gig Workers Need to Know About Filing 2020 Taxes. Schedule SE is used to calculate your self-employment taxes.

How To File Self-Employment Taxes. TurboTax Helps You File Self-Employed Taxes The Way You Want And With Confidence. You will also need to include Schedule 1 and Schedule C with your tax return. Use our self-employed tax deductions worksheet and fill out a self-employment tax form.

The basic steps for filing. Also you should pay a self-employment tax. If you own a small business or work as a freelancer Uncle Sam. Ad Self-Employed Tax Breaks.

Use the income or loss calculated on Schedule C to. Determine If You Qualify as Self-Employed. Ad Free tax support and direct deposit. Yes you will need to file Form 1040.

Learn your self-employment tax rate it changes from year to year and the Social Security tax youre expected to cover. Get the tax answers you need. Instead you must report your self-employment income on Schedule C Form 1040 to report income or loss from any. TurboTax Helps You File Self-Employed Taxes The Way You Want And With Confidence.

Ad Our clients typically receive refunds 7061 greater than the national average. Learn More From AARP. Ad The simple easy and 100 accurate way to file taxes online. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed.

Free FederalFederal Tax Prep and Filing For Everyone. Talk to a 1-800Accountant Small Business Tax expert. Here Are Things to Keep In Mind Before Filing Your Taxes.

7 Self Employment Tax Forms For Home Business Owners Tax Forms Self Employment Business Tax

Tips To File Self Employed Taxes Money Bliss Small Business Tax Tax Money Business Tax

How To File Self Employed Taxes Everything You Need To Know Honeybook Profitable Small Business Ideas Tax Guide Need To Know

How To File Self Employment Taxes The Ultimate Guide Self Employment Business Tax Employment

Posting Komentar untuk "how to file for self employment on taxes"